Do You Have Forex Strategy ?

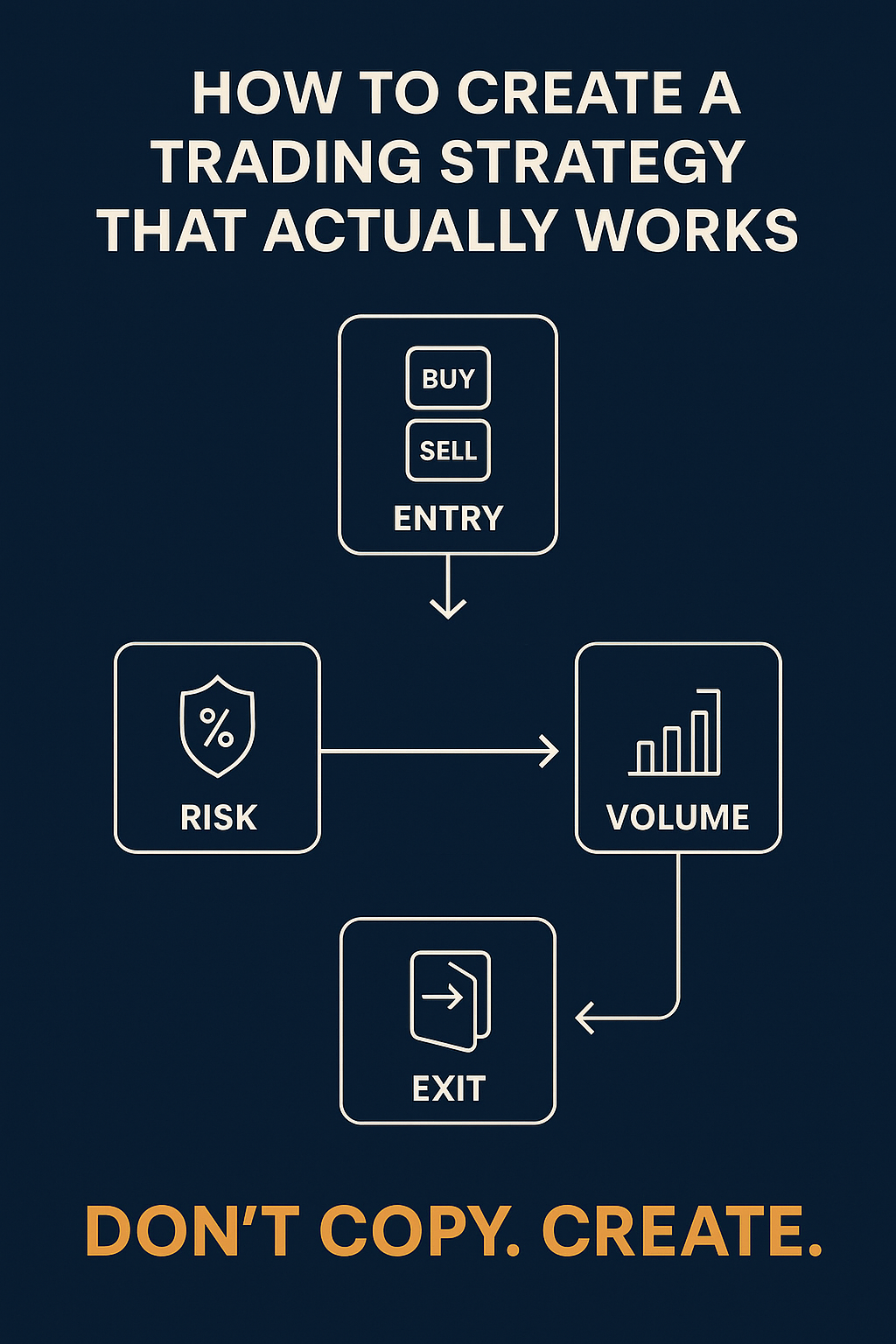

How to Create a Trading Strategy That Actually Works

Don’t Copy. Create.

In the Forex world, copying someone else’s trading strategy might look like a shortcut to success — but it’s often a fast track to failure. The truth? No one else trades with your mindset, risk appetite, or financial goals. That’s why building your own trading strategy isn’t just smart — it’s essential.

Let’s walk through a practical roadmap to help you create a trading strategy that’s custom-built for you and that actually works.

Step 1: Define Your Trading Style

Before anything else, ask yourself:

- Are you a scalper, day trader, or swing trader?

- Do you prefer short bursts of action or holding trades overnight?

- How many hours a day can you realistically trade?

Tip: Your lifestyle should define your trading style — not the other way around.

Step 2: Entry Criteria – When to Get In

Set clear, measurable rules to identify a valid trade setup. These might include:

- Technical indicators (e.g., RSI below 30 = oversold)

- Candlestick patterns (e.g., bullish engulfing on support)

- Price action zones (support/resistance, trendlines)

- Fundamental triggers (economic news, interest rate decisions)

Rule of thumb: No more than 2–3 filters for clean decision-making.

Step 3: Risk Management – Protect Your Capital

Ask any seasoned trader and they’ll tell you: Risk management is more important than trade direction.

Key elements:

- Position Sizing: Risk only 1–2% of your account per trade

- Stop Loss Placement: Always set a stop — don’t rely on gut feeling

- Risk-to-Reward Ratio: Aim for a minimum of 1:2 or 1:3 on each setup

Never move your stop to “hope” for recovery. Stick to your plan.

Step 4: Volume and Lot Size

Adjust your lot size based on your account size and stop loss distance. For example, trading 1 lot with a 10-pip stop vs. a 50-pip stop drastically changes your exposure.

Use a position size calculator to stay consistent and avoid over-leverage.

Step 5: Exit Strategy – Know When to Get Out

Many traders have great entries but poor exits. Define:

- Take Profit (TP): Based on technical targets, R:R ratio, or market structure

- Trailing Stop: To protect profits as price moves

- Time-based Exit: If price doesn’t move in your favor within X hours/sessions

Exit discipline is what turns “almost profitable” traders into real ones.

Step 6: Test It. Tweak It. Trust It.

Before going live, backtest your strategy on historical data. Then demo trade it for a few weeks.

Track every trade in a trading journal, including:

- Why you entered

- What happened

- What could’ve been better

Your first version won’t be perfect. That’s okay. The goal is improvement, not instant perfection.

Build to Believe

A powerful strategy isn’t downloaded. It’s developed.

By following a structured approach — from entry rules to risk to exits — you’ll gain confidence, clarity, and control over your trades. And when your strategy is yours, you’re no longer chasing others — you’re leading yourself.

Want to Build Your Strategy With Experts?

At PrimeXar, our certified trainers help you develop proven trading strategies from scratch — with live sessions, recorded videos, and personalized Q&As.